|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

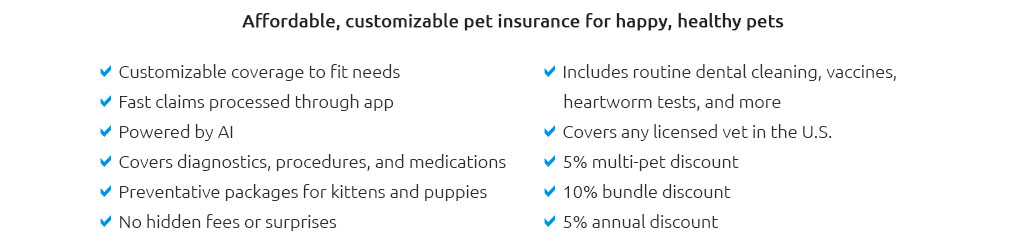

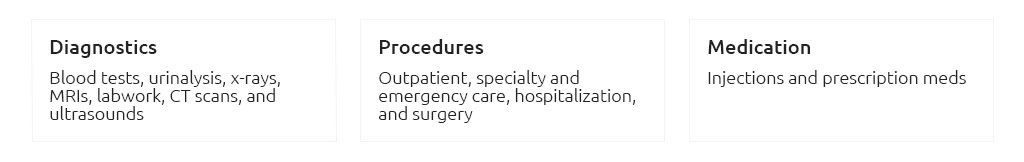

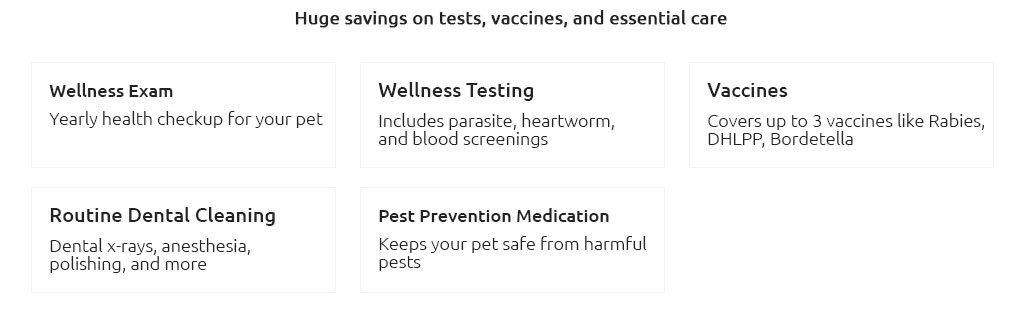

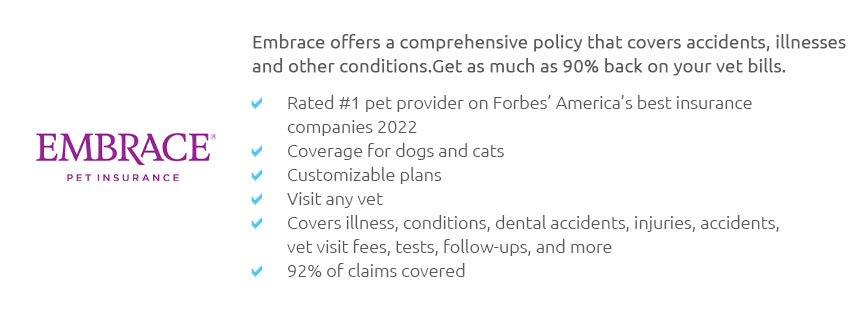

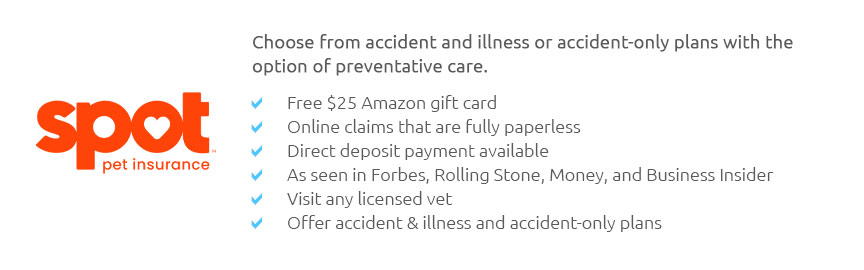

Understanding the Best Pet Insurance Options in OhioFor pet owners in Ohio, choosing the best pet insurance can be a daunting task, given the variety of options available in the market. Navigating through numerous plans, coverage details, and pricing can feel overwhelming, but fear not, as we're here to help you understand the nuances of pet insurance in the Buckeye State. Whether you're a first-time pet owner or a seasoned animal enthusiast, finding the right insurance plan is crucial for ensuring your furry friends receive the best care possible. Why Consider Pet Insurance? In Ohio, as in many other states, veterinary care costs have been on the rise. From routine check-ups to emergency surgeries, the expenses can quickly add up. Pet insurance can offer a financial safety net, helping to mitigate the costs associated with unexpected illnesses or injuries. By paying a monthly premium, pet owners can have peace of mind knowing that they are prepared for unforeseen veterinary bills. What to Look for in Pet Insurance When evaluating pet insurance options, there are several factors to consider. Coverage types are critical; some policies cover only accidents and illnesses, while others may include wellness care such as vaccinations and dental cleanings. It's important to assess what level of coverage aligns with your pet's needs and your budget. Additionally, pay attention to deductibles, reimbursement rates, and annual coverage limits. A lower deductible might mean higher premiums, but it can be beneficial if your pet requires frequent care. Similarly, higher reimbursement rates can lead to lower out-of-pocket expenses during a claim. Top Pet Insurance Providers in Ohio Several companies stand out in Ohio for their comprehensive offerings and customer satisfaction.

Pros and Cons of Pet Insurance Like any financial product, pet insurance has its pros and cons. On the positive side, it offers financial protection and peace of mind, making it easier to make decisions based on your pet's health rather than cost. However, some might find the monthly premiums a bit steep, especially if they rarely visit the vet. Additionally, pre-existing conditions are generally not covered, which can be a limitation for older pets or those with chronic issues. Ultimately, deciding on the best pet insurance in Ohio involves weighing these pros and cons, assessing different providers, and considering your pet's specific healthcare needs. By taking the time to research and compare options, you can ensure that you are making an informed decision that protects both your pet and your wallet. https://www.insuranceopedia.com/pet-insurance/best-pet-insurance-ohio

In Ohio, Lemonade Pet Insurance leads as the top pet insurance provider. We've saved shoppers an average of $350 per year on their pet insurance. https://money.com/best-pet-insurance-ohio/

The best pet insurance providers in Ohio exhibit common traits. They commonly provide a range of plan options, extensive coverage, prompt claim processing, and ... https://www.petinsurancereview.com/pet-insurance/OH

OUTSTANDING - 10+ stars if I could! This insurance company actually has heart and a passion (clearly) for customer service. I can't say enough amazing things ...

|